Open Enrollment

Maryville University

Benefits Open Enrollment for 2024

Monday, October 23rd -Friday, November 3rd

Open enrollment for benefit plans effective January 1, 2023, begins at 12:01 a.m. on Monday, October 23rd, and runs through 11:00 p.m. on Friday, November 3rd.

This year’s enrollment will be a passive enrollment, meaning that if no elections have been made at the close of the open enrollment window, current elections will carry over. HOWEVER: if you wish to participate in the Health Savings Account (HSA), Flexible Spending Account (FSA) or Dependent Spending Account in 2024, Annual enrollment is required as these elections will not roll over from year to year.

(Enrollment Begins Oct. 23 & ends Nov. 3)

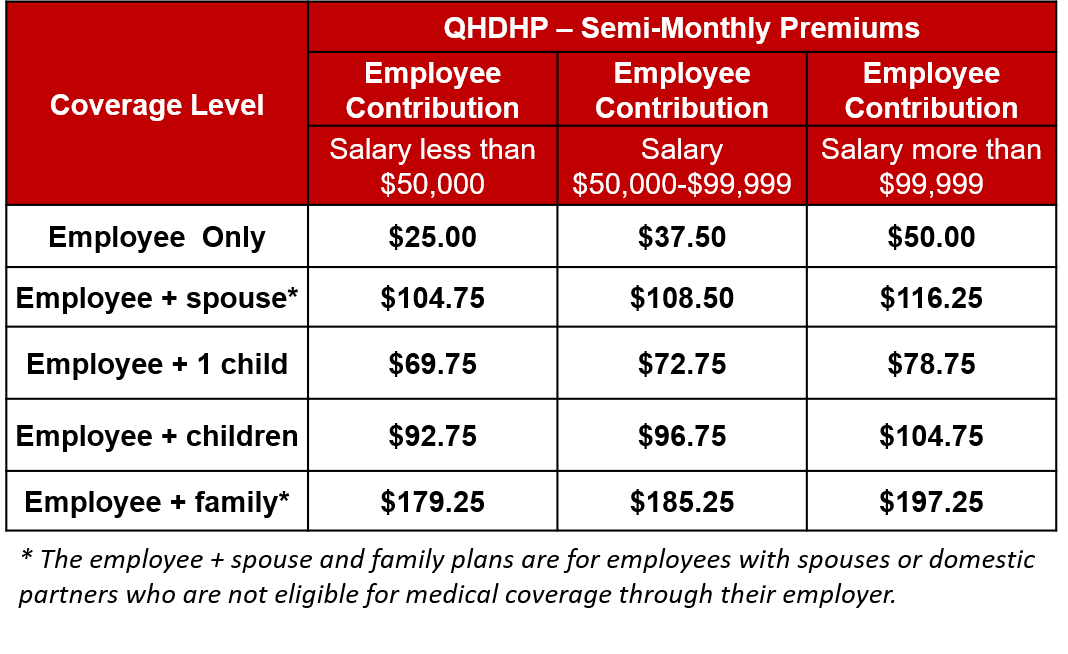

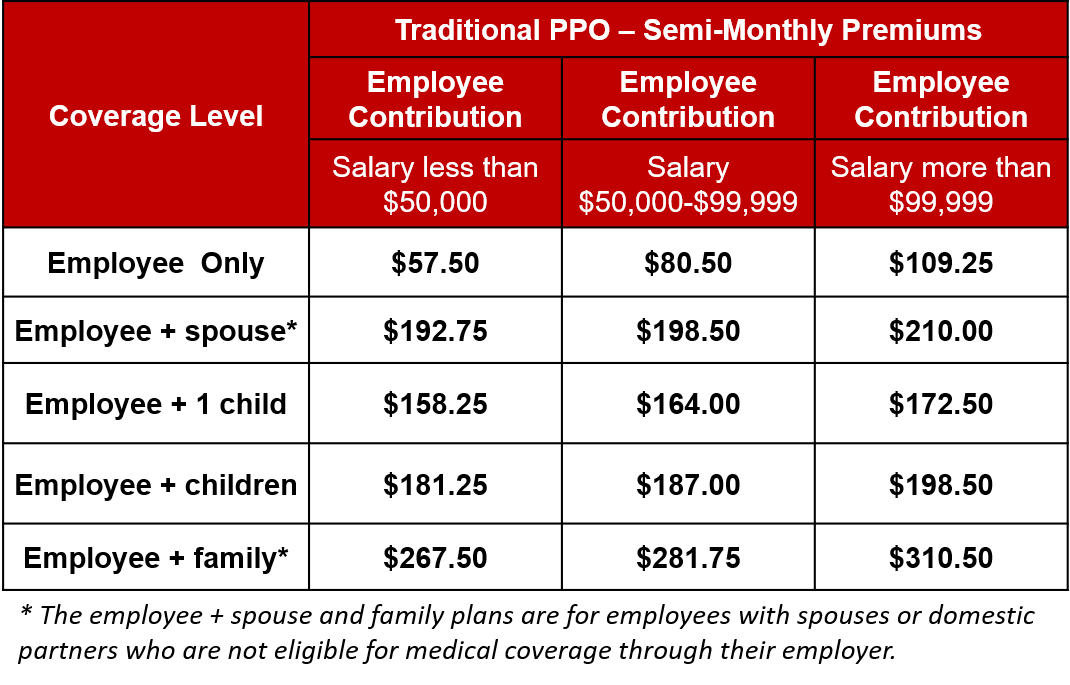

- MEDICAL: No changes to premiums or plans.

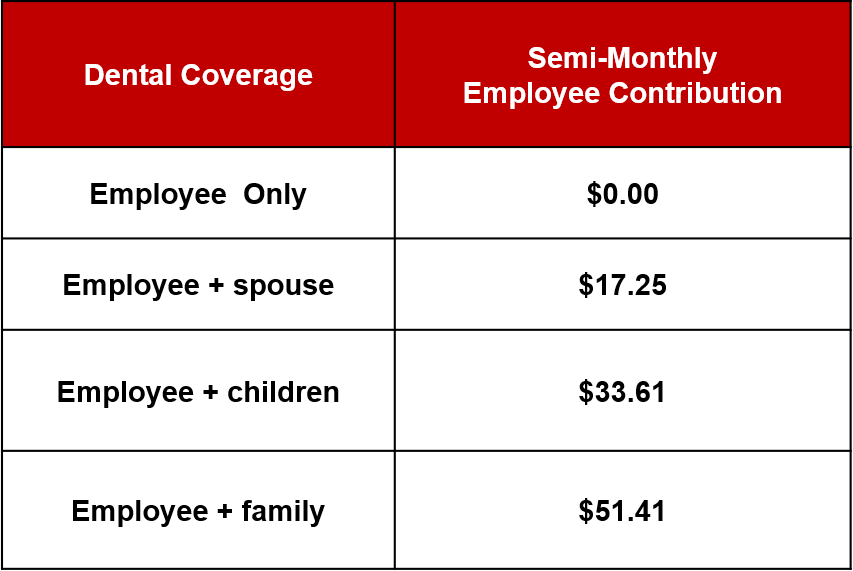

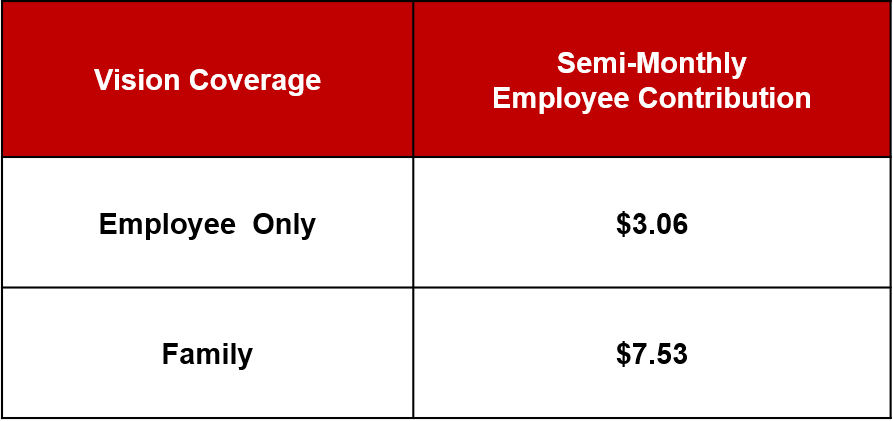

- DENTAL & VISION PREMIUMS: Delta Dental and Delta Vision remain our vendors, but there will be slight premium increases in both for the upcoming plan year. See below for the new premium chart.

- LIFE INSURANCE: Our vendor is changing from the Hartford to New York Life. All existing Supplemental/Voluntary Coverages will transfer. There will be a slight increase in supplemental coverages for all three voluntary life benefits (Employee Life, Spousal Life and Child Life), but all plans will now also include Accidental Death & Dismemberment.

- WELLNESS: After Nov. 30th, employees participating in both the high deductible and PPO medical plans will begin working toward a $50 reduction in medical premiums for 2025 during the next wellness year (December 1, 2023 – November 30, 2024). This is the final year for the $500 HSA deposit.

- SPENDING ACCOUNTS: No changes to vendors. Employees must re-enroll during open enrollment for HSA, FSA, and Dependent Spending Account.

Virtual Sessions

Wednesday, October 18th

9:30 a.m. (CST)

Thursday, October 19th

11 a.m. (CST)

Not able to attend one of our sessions?

View the recording below.

View the recording below.

(No Audio)

- How do I make changes to my current elections?

You will log in to the ADP portal to make changes to your current elections. You will also be able to sign up for contributions to your health savings account, flexible spending account, or dependent spending account – if applicable.

- I want to keep my current elections. Do I need to do anything?

For medical: NO. Your current election will roll over to 2024.

For ancillary benefits – vision, dental, life insurance, short-term disability, long-term disability, and long-term care: No action is needed. These benefits will automatically roll over to next year.

What are Ancillary benefits?

- At Maryville ancillary benefits include dental, vision, life, long-term care, and short-term and long-term disability insurance

- Can I make changes after open enrollment?

Plan changes may be made outside of open enrollment if an employee experiences a life event such as marriage, divorce, birth, adoption, or death in the family. Loss of other coverage by a spouse/domestic partner or eligible dependent is also considered a life event.

Evidence of a life event or coverage loss is required.

- Whom should I contact for more information?

Please complete the “Submit A Question” form above or send your question to HR@Maryville.edu.

- Can my spouse or domestic partner and dependents be insured through Maryville as well?

- Spouses and domestic partners are not eligible for Maryville medical coverage if they have the ability to elect coverage through their own employer.

- All dependents of Maryville employees are eligible for coverage through the Maryville medical plans.

- Will my spouse or domestic partner still be eligible to be covered under the dental and vision plans?

The spousal carve-out is only for the medical plan. Spouses and domestic partners may still be covered under the dental and vision plans.

- My spouse or domestic partner is not eligible for medical insurance through their employer. What do I need to do to enroll them?

If your spouse or domestic partner isn’t eligible for healthcare through their employer, they are eligible to participate in the Maryville plan. Participating employees and spouses/ domestic partners must sign an affidavit acknowledging that they are unable to obtain coverage elsewhere. You will be prompted with the Spousal Affidavit form when you enroll for spousal coverage in the Open Enrollment portal. Employees found to be falsifying information on their affidavit will be subject to disciplinary actions up to and including termination.

- My spouse or domestic partner is self-employed, unemployed, or retired. Are they eligible for medical coverage?

Yes, your spouse or domestic partner is eligible for medical coverage if they do not have coverage via employment. They will also need to submit the Affidavit.

- I participated in the wellness program this year. Will I still get my reward

- Employees participating in the high deductible health plan who qualify for the employer contribution for 2023 will receive their reward in December 2023. The upcoming wellness program will cover from Dec. 1, 2023, through Nov. 30, 2024. In 2024, employees in the high deductible health plan will earn points to receive a $50 monthly discount in their medical premium for 2025.

- Employees participating in the Traditional PPO who complete the required activities and points by Nov. 30, 2023, will receive a $50 monthly discount in their medical premium for 2024.

- How can I find doctors in our new network?

- Follow these instructions to search the United Healthcare Choice Plus network of providers.

- What do I need to know about the change from The Hartford to New York Life?

- All employees should verify that their beneficiary information is accurate.

- There will be no change in the basic life, accidental death & dismemberment, or long-term disability coverages provided to you by the University.

- Supplemental life insurance (employee, spouse, child) will now include accidental death & dismemberment coverage.

- There is a slight increase in the cost of supplemental coverage. This will be available during the open enrollment process.

- All current coverage will automatically move to NY Life.

- Employees wishing to enroll in supplemental life insurance will have guaranteed issue of three times their annual salary up to a maximum of $130,000 during open enrollment.

- Amounts of new coverage over the guaranteed issue will require employees to submit Evidence of Insurability.

- Current Short Term Disability coverage will transfer to NY Life.

- New STD enrollments will be guaranteed issue during open enrollment.